Preparing for the arrival of a baby involves more than choosing a name or decorating a nursery. It’s crucial to focus on your finances to ensure a stable future for your growing family. Understanding how to financially prepare for parenthood can seem overwhelming, but taking the right steps early on is essential. Let’s explore key strategies to help you get started.

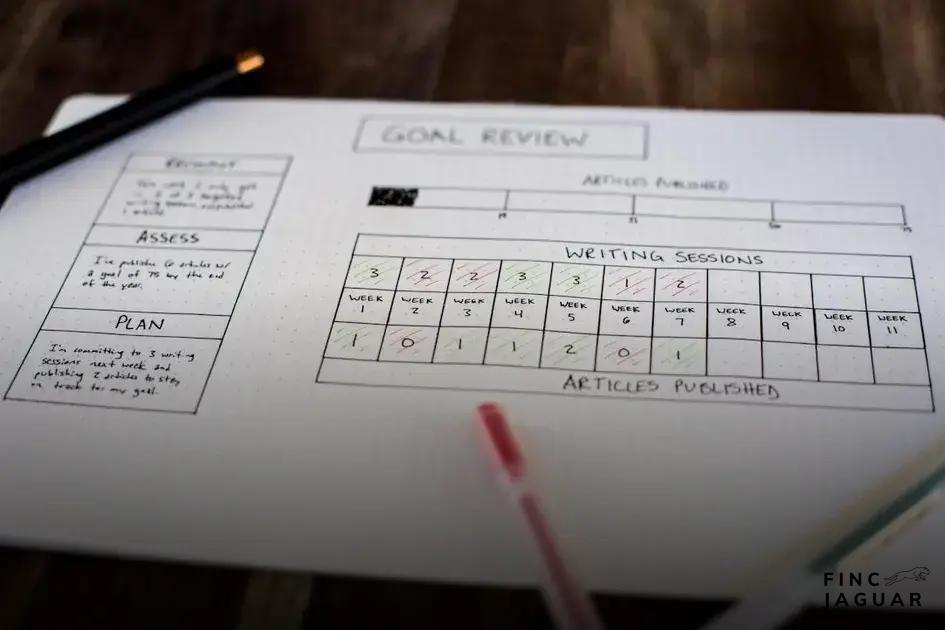

Assess Your Current Financial Situation

Before you set out on your journey into parenthood, it is imperative to get a clear understanding of your current financial situation. This involves taking a holistic look at all your income sources, expenses, outstanding debts, and savings. Knowing where you stand financially helps you identify areas that may need adjustment to prepare for the upcoming changes that a new arrival brings.

Start by reviewing your monthly income. Include all sources, such as salaries, part-time jobs, freelance gigs, or any passive income. Bust out your bank statements and categorize each type of expenditure you have. From necessary bills like rent and utilities to those sneaky subscriptions you forgot about, track exactly where your money goes every month.

After you’ve gathered an overview of your spending, it’s time to evaluate your outstanding debts. Knowing what you owe—and to whom—allows you to prioritize repayments and decide if consolidation might be right for you. Eliminating or restructuring high-interest debt before your baby arrives could relieve significant financial stress later.

Don’t forget to include your savings as part of this assessment. Check your emergency fund, retirement accounts, and any other savings. Establishing a solid emergency fund with at least three to six months of living expenses is particularly crucial as unexpected expenditures may arise.

By assessing and documenting your current financial situation, you set a clear starting point for the financial planning necessary for a growing family. Remember, clarity on your finances today leads to better decisions tomorrow.

Create a Baby Budget

Creating a baby budget is an essential step in preparing for the financial responsibilities of parenthood. Begin by listing all potential expenses related to the arrival of your baby. This can include items such as diapers, clothing, and furniture.

Healthcare Costs

also form a significant part of the initial expenses.

It’s crucial to research and estimate these costs accurately. Look into your health insurance details to understand what is covered and what additional expenses you might incur. Having a buffer for unexpected medical expenses is advisable.

Next, consider ongoing monthly expenses. These might include childcare, food for your baby, and health insurance premiums. Factoring in these costs helps in creating a realistic budget that reflects the new family’s needs.

To ensure you are financially prepared, establish a system to maintain and update this budget regularly. This will help you track spending patterns and make any necessary adjustments as your child’s needs evolve. By taking these steps, you’ll set a strong financial foundation for welcoming your new family member.

Start Saving Early

One key to easing the stress of future parenthood is to start saving early. Initiating a savings plan sooner rather than later gives you a longer time frame to build up a financial cushion. Even setting aside a small amount each month can add up significantly over time due to the power of compounding interest.

Begin by opening a dedicated savings account specifically for baby-related expenses. This helps you keep track of the funds intended for your child and ensures they are used appropriately. Automating transfers to this account each payday can make saving easier and more consistent.

Emergency Fund

Consider building an emergency fund if you haven’t already. Life is unpredictable, and having a buffer for unforeseen expenses can bring peace of mind. Ideally, aim to save three to six months’ worth of living expenses. This not only covers emergencies but also provides a financial safety net during the transition into parenthood.

Utilize resources available at your disposal such as employer-sponsored savings plans or childcare cost forecasts. Understanding the financial landscape as it pertains to child-rearing costs helps you devise a robust savings strategy.

Allocate resources wisely by identifying where you can cut back on current discretionary spending. Redirect these funds into your baby’s savings account. Additionally, consider long-term investment options like 529 plans or similar educational savings plans. Early contributions allow the funds to grow over time, reducing future financial burdens related to education.

Plan for Long-term Financial Goals

Setting long-term financial goals is a crucial step in preparing for the financial responsibilities of parenthood. Begin by identifying your key objectives, such as saving for your child’s education, building an emergency fund, and ensuring a stable retirement plan.

To make this process manageable, break these goals down into smaller, achievable milestones. For example, if you’re saving for college, calculate how much you need to put aside monthly to reach that goal by the time your child is ready for college.

Consider leveraging a variety of financial instruments to grow your savings over time. Options include investment accounts, 529 college savings plans, and retirement accounts tailored to your needs. Diversifying your investments can help you balance risk and reward effectively.

Automate your savings to ensure consistent contributions toward your goals. Set up automatic transfers from your checking account to your savings or investment accounts. This helps in creating a disciplined savings habit without the need for monthly reminders.

Regularly review and adjust your financial plan to accommodate changes in your family’s needs or economic circumstances. Reassessing your plan annually will ensure you stay on track with your long-term objectives.

Engage with a financial advisor if you find planning challenging, especially when dealing with complex investment strategies or tailoring your approach to fit your family’s unique situation. Their expertise can help optimize your financial strategy and provide peace of mind.